Many people we speak to know that there are certain tax benefits to buying a car through a limited company, but few business owners understand the full tax implications there are when deciding what car to purchase for personal use, and how to finance it. This 3-part blog hopes to provide readers with an overview of some of the key points to consider when looking at purchasing a car through a limited company.

These blog’s will explore:

- Company car choice – Electric vs fuel.

- Financing – Contract hire, lease or cash/finance, tax impact and accounting treatment considerations.

- Benefit In Kind – Company-provided car benefits.

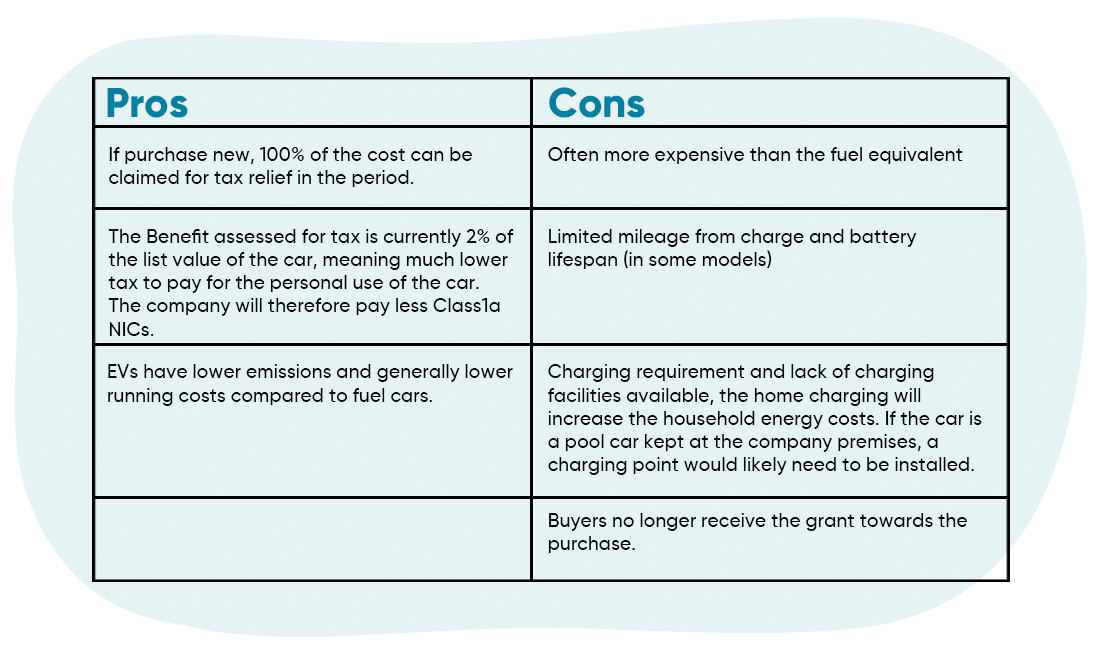

Pros and Cons summary of purchasing an Electric Vehicle through a business:

Note – this blog looks at the regular cars, not commercial vehicles, purchased through a limited company. For Tax illustrations, we will assume Corporation Tax rates will apply at 25%.

Electric or Fuel?

The cost of buying electric cars can be more expensive than petrol or diesel vehicles, this means that the initial outlay for the business is more, whether that be through cash purchase, finance options or rolling lease payments. While there might be a slight initial impact on the company’s finance when acquiring an electric car, the overall maintenance and running costs are often cheaper in the long run.

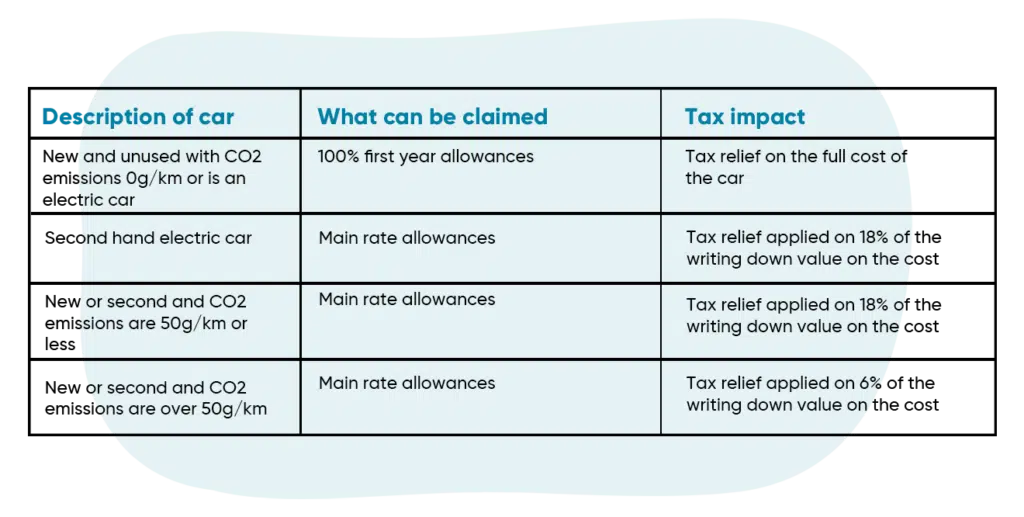

If you are considering the option of purchasing a vehicle as an asset of the company, the company can get tax relief through capital allowances in their Corporation Tax return. For cars, the capital allowances and tax relief follows the emissions of the car, however, HMRC have restricted the tax relief awarded on the purchase of fuel cars.

The current rates for cars purchased after April 2021 are as follows:

Hybrid Vehicles

Hybrid’s have a part-electric range and part fuel, the capital allowances are the same as a normal fuel car and are likely to be pooled in the main-rate. However, from a benefit-in-kind (BIK) perspective, the electric range of the hybrid vehicle will determine the % applied to the list price of the car to arrive at the BIK value.

For more information on company cars, get in touch with a member of #TeamSAS