Part 1:

A workplace pension scheme is a way of saving for retirement through contributions deducted directly from employees’ wages. The employer may also make contributions to an employee’s pension through the scheme. If employees’ are eligible for automatic enrolment, the employer has to make contributions into the scheme.

Who is responsible?

Employers have to provide a workplace pension scheme for eligible staff as soon as your first member of staff starts working for you (known as your ‘duties start date’).

If, as an employer, you are unsure whether you would have a responsibility for providing a workplace pension scheme then we would recommend checking The Pensions Regulator website and completing a short questionnaire.

Who does it apply to?

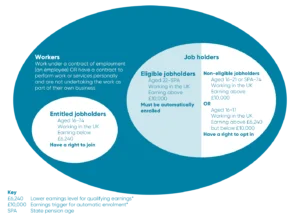

You must enrol and make an employer’s contribution for all staff who:

- are aged between 22 and the State Pension age

- earn at least £10,000 a year

- normally work in the UK (this includes people who are based in the UK but travel abroad for work)

If staff become eligible because of a change in their age or earnings, you must put them into your pension scheme and write to them within 6 weeks of the day they meet the criteria.

If staff are assessed as non-eligible then they can request to opt into automatic enrolment. If they are assessed as an entitled worker then they can still join the pension scheme if they wish.

Choosing a scheme and automatic enrolment

You will need to choose a pension provider and set a scheme up. Click here to view The Pensions Regulator recommended scheme providers.

There are different types of pension. The 2 main types are defined contribution (DC) – a pension pot based on how much is paid in and defined benefit (DB) – usually a workplace pension based on salary and how long an employee has worked for the employer. Most employers tend to use a DC scheme and there are different variations to this type.

- Relief at Source

- Net Pay

- Salary Sacrifice

Please take into consideration what type of scheme you want to set up when choosing your pension provider.

Once you have chosen a scheme and set the pension up with the provider then you will need to write to your employees and advise them of the auto enrolment process. If you choose to use postponement (you can postpone employees from auto-enrolment for up to 3 months) then you must put this in writing within 6 weeks of the employees start date.

Every 3 years you must complete the re-enrolment process by re-enrolling all eligible staff who are not currently in the pension and have opted out previously.

if you need any advice please get in touch with our Payroll team at SAS